Vos solutions d’impression et de communication sur mesure.

Bookkeeping

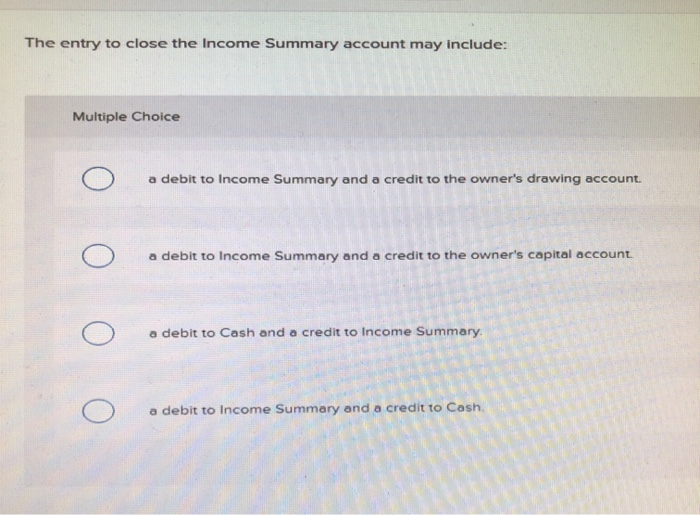

Income Summary Account and Closing Process

février 28, 2023 root-med-impression No Comment

The term “net” relates to what’s left of a balance after deductions have been made from it. Kristin is a Certified Public Accountant with 15 years of experience working with small business owners in all aspects of business building. In 2006, she obtained her MS in Accounting and Taxation and was diagnosed with Hodgkin’s Lymphoma two months later. Instead of focusing on the fear and anger, she started her accounting and consulting firm.

Close income summary account

A company with a $5,000 balance in the income summary account must credit retained earnings for $5,000. This entry closes the income summary account and transfers the $5,000 to retained earnings. The $5,000 credit entry illustrates an increase in the company’s retained earnings account. Credit the income summary account for the amount contained in the company’s revenue account.

Preparing a Closing Entry

Our T-account for Retained Earnings now has the desired balance. The balance in Retained Earnings was $8,200 before completing the Statement of Retained Earnings. According to the statement, the balance in Retained Earnings should be $13,000. Overall, in 2022, their income across all sources accounted for a mammoth $2.4 billion or $5.41 for each diluted common share.

Temporary vs. permanent accounts

- The income summary account is only used in closing process accounting.

- As mentioned, temporary accounts in the general ledger consist of income statement accounts such as sales or expense accounts.

- The company can make the income summary journal entry for the expenses by debiting the income summary account and crediting the expense account.

- Whatever accounting period you select, make sure to be consistent and not jump between frequencies.

On the other hand, if it is on the debit, it presents the net loss of the company. I imagine some of you are starting to wonder if there is an end to the types of journal entries in the accounting cycle! So far we have reviewed day-to-day journal entries and adjusting journal entries. This account follows the double-entry system of bookkeeping. If the credit side is greater than the debit side, the company or the individual is said to have been profitable in the assessment period.

Types of Accounts

Dividends are close to the income summary and retained earnings. Therefore, the retained earnings account shows the earnings that are kept, net income fewer dividends in the business. Moreover, the closing procedure shows that revenue, expense, and dividend accounts are retained earnings subcategories. If the company profits for the year, the retained earnings will come on the debit side of the income summary account. Conversely, if the company bears a loss in the year, it comes on the credit side of the income summary account.

We need to complete entries to update the balance in Retained Earnings so it reflects the balance on the Statement of Retained Earnings. We know the change in the balance includes net income and dividends. Therefore, we need to transfer the balances in revenue, expenses and dividends (the temporary accounts) into Retained Earnings to update the balance. A closing entry is a journal entry that is made at the end of an accounting period to transfer balances from a temporary account to a permanent account. The company can make the closing entry for revenues by debiting all the revenues accounts and crediting the income summary account.

Once the temporary accounts are closed to the income summary account, the balances are held there until final closing entries are made. Once all the temporary accounts are closed, the balance in the income summary account should be equal to the net income of the company for the year. Each of these accounts must be zeroed out so that on the first day of the year, we can start tracking these balances for the new fiscal year. Remember that the periodicity principle states that financial statements should cover a defined period of time, generally one year. The purpose of closing entries is to prepare the temporary accounts for the next accounting period.

Capital One Financial Corporation declared their net income closing entries for the fourth quarter of 2022. It was declared at $1.2 billion or %3.03 for each diluted common share. The following video summarizes how to prepare closing entries. Net income is the portion of gross income that’s left over after all expenses have been met.

It’s not reported on any financial statements because it’s only used during the closing process and the account balance is zero at the end of the closing process. After these two entries, the revenue and expense accounts apps for accountants have zero balances. Rather than closing the revenue and expense accounts directly to Retained Earnings and possibly missing something by accident, we use an account called Income Summary to close these accounts.

Let’s move on to learn about how to record closing those temporary accounts. The balance in Retained Earnings agrees to the Statement of Retained Earnings and all of the temporary accounts have zero balances. The trial balance, after the closing entries are completed, is now ready for the new year to begin. Think back to all the journal entries you’ve completed so far. Have you ever done an entry that included Retained Earnings?

All drawing accounts are closed to the respective capital accounts at the end of the accounting period. To close expenses, we simply credit the expense accounts and debit Income Summary. Temporary accounts include all revenue and expense accounts, and also withdrawal accounts of owner/s in the case of sole proprietorships and partnerships (dividends for corporations).

Next PostРастровая и векторная графика: суть, преимущества и различия

Previous PostРоботы для Форекс торговые советники для заработка на бирже: лучшие автоматизированные программы для торговли бесплатно

Related Posts

novembre 2, 2023

root-med-impression

0

-

“Taxes On Casino Profits How Much Carry Out You Have To Win To Spend Tax?

No CommentJan 17, 2025

-

“Taxes On Casino Profits How Much Carry Out You Have To Win To Spend Tax?

Jan 17, 2025

-

How To Play Roulette: Complete Guide In Order To The Game

No CommentJan 17, 2025

-

How To Play Roulette: Complete Guide In Order To The Game

Jan 17, 2025

-

Site Oficial Simply No Brasil Apostas Esportivas E Cassino Online

No CommentJan 17, 2025

Commentaires récents

A WordPress Commenter dans Hello world!

Archives

- janvier 2025

- décembre 2024

- novembre 2024

- octobre 2024

- septembre 2024

- août 2024

- juillet 2024

- juin 2024

- mai 2024

- avril 2024

- février 2024

- janvier 2024

- décembre 2023

- novembre 2023

- octobre 2023

- septembre 2023

- août 2023

- mai 2023

- avril 2023

- février 2023

- décembre 2022

- novembre 2022

- juin 2022

- mai 2022

- janvier 2022

- décembre 2021

- octobre 2021

- mai 2021

- mars 2021

- décembre 2019

- novembre 2019

Catégories

- ! Без рубрики

- 1Win Brasil

- 1win Brazil

- 1win India

- 1WIN Official In Russia

- 1win Turkiye

- 1win uzbekistan

- 1winRussia

- 1xbet Korea

- 1xbet pt

- 1xbet Russian

- 22bet IT

- AI in Cybersecurity

- Aviator

- aviator ng

- Bankobet

- Basaribet

- bizzo casino

- Bookkeeping

- Bookstime

- casino

- casino en ligne fr

- casino onlina ca

- casino online ar

- casinò online it

- casinos

- Crafting

- Cryptocurrency exchange

- Event

- Fashion

- FinTech

- Forex Trading

- Gama Casino

- Handmade

- illiya

- Interior

- Interview

- IT Education

- IT Вакансії

- IT Образование

- Jewelry

- Kasyno Online PL

- king johnnie

- Lifestyle

- Masalbet

- mostbet ozbekistonda

- Mostbet Russia

- mostbet tr

- New Post

- online casino au

- Pin Up Peru

- pinco

- Qizilbilet

- Ramenbet

- ricky casino australia

- Sober living

- Software development

- sweet bonanza TR

- test content

- Uncategorized

- verde casino hungary

- Комета Казино

- Новости Криптовалют

- Финтех

- Форекс Брокеры

- Форекс Обучение